Disclaimer: You should consult a qualified accountant or tax expert if in doubt about your obligations. You are responsible for complying with all relevant laws in the regions you sell and are solely responsible for registering or collecting the relevant taxes.

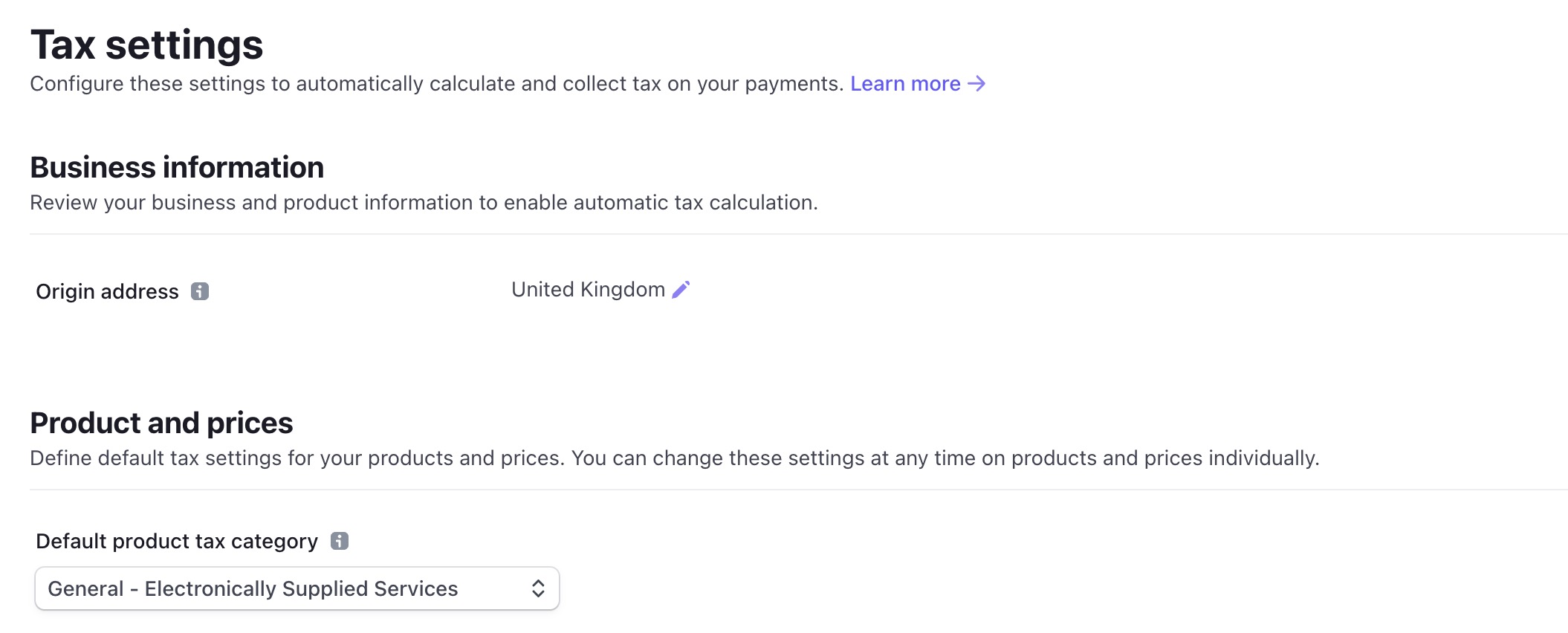

If you need to collect sales tax, VAT or GST on your store sales you can have Stripe automatically calculate the taxes due on each order in the checkout. Stripe caclulates this based on:

- Your origin location (where you are based)

- Where you are registered for taxes

- Your customers address

Thresholds for registering for taxes vary significantly and differnt products or services are taxed in different ways. Stripe's tax calculations help to simply this by calculating everything for you, maintaining approriate records and giving you insight into where you may need to register for taxes.

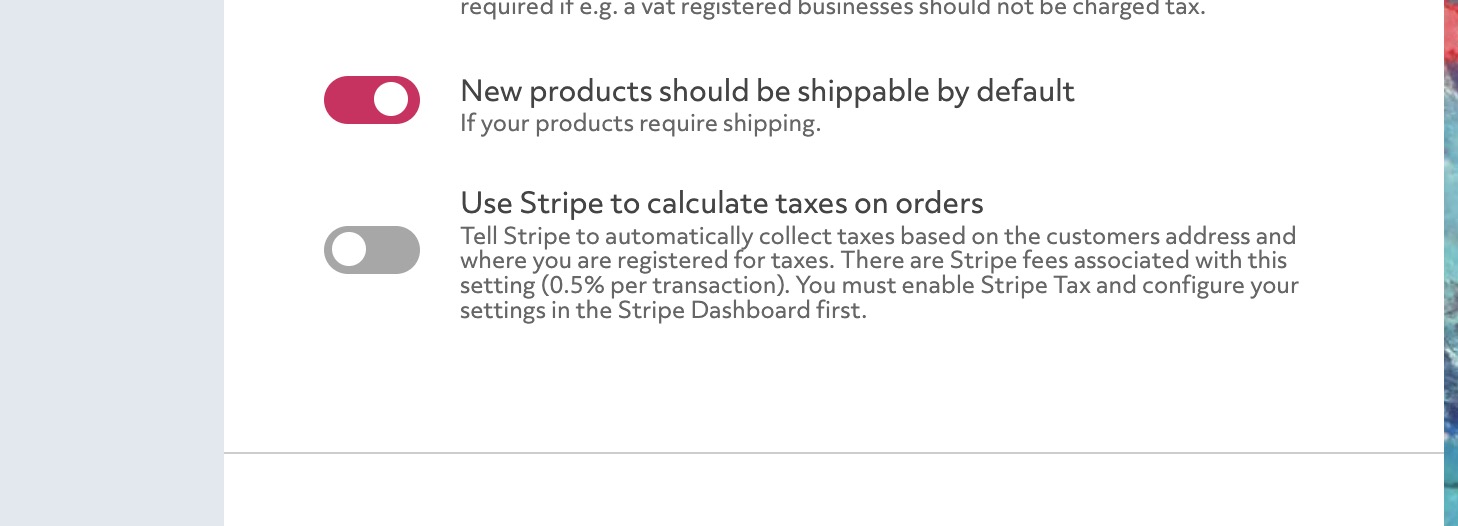

Please note that Stripe charge for their tax product, this is currently a 0.5% fee deducted from every payment (on top of their usual payment processing fees). See more here .

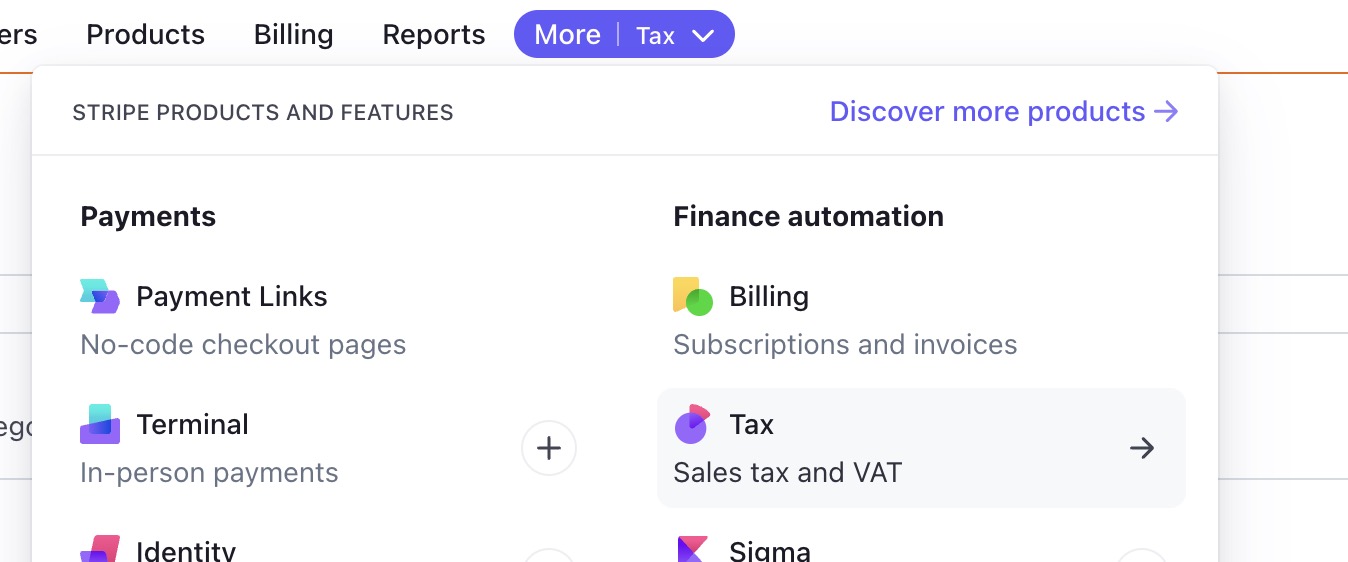

To begin collecting taxes:

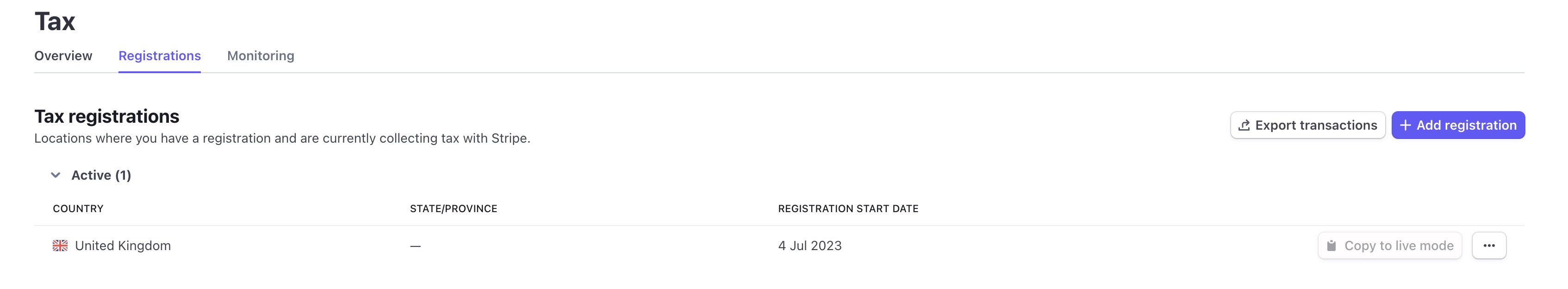

IMPORANT: Only enter tax registrations where you are actually registered with the approriate tax authority to collect Sales Tax, VAT or GST. For example if you are registered in the UK for VAT you would add a UK VAT registration:

Edit each product under "Store" in the left sidebar to ensure they have the correct tax code set. If the tax code is wrong the wrong amount of tax may be calculated.